Predicting Tesla’s Value in 2030: A Look at Factors Shaping the Future

Predicting Tesla’s Value in 2030: A Look at Factors Shaping the Future

Introduction

In this auspicious occasion, we are delighted to delve into the intriguing topic related to Predicting Tesla’s Value in 2030: A Look at Factors Shaping the Future. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Predicting Tesla’s Value in 2030: A Look at Factors Shaping the Future

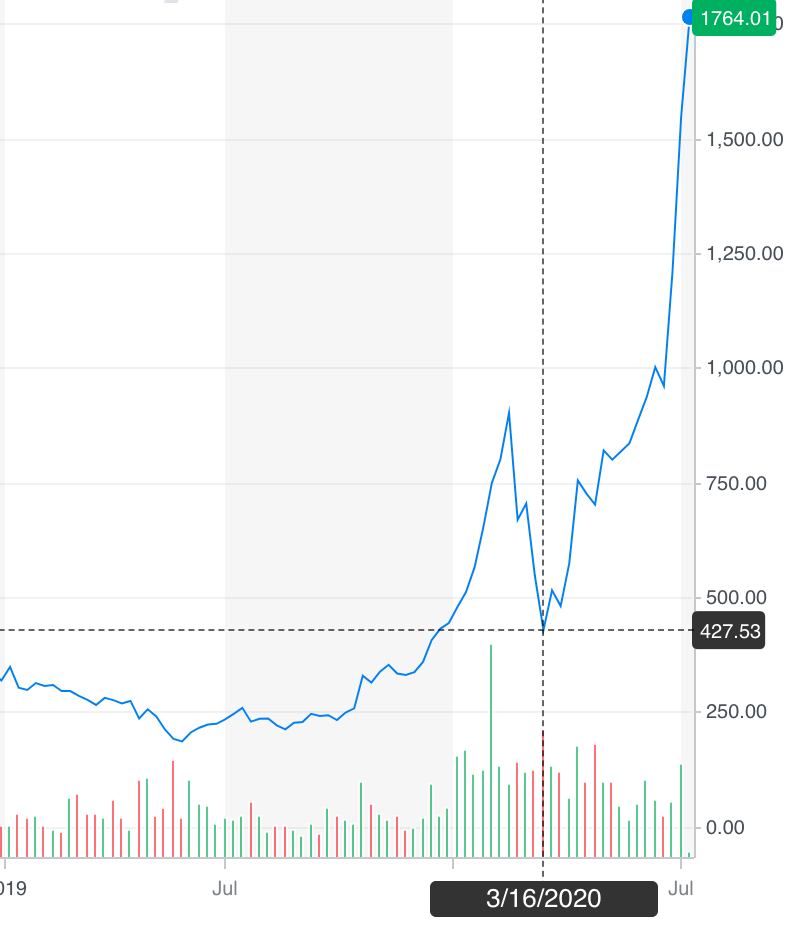

Predicting the future value of any company, particularly one as dynamic and innovative as Tesla, is a complex endeavor. Numerous factors, both internal and external, influence a company’s trajectory. While no definitive answer exists, examining key drivers and potential scenarios offers valuable insights into Tesla’s potential worth in 2030.

Key Drivers of Tesla’s Future Value

Several factors will play a crucial role in shaping Tesla’s future value:

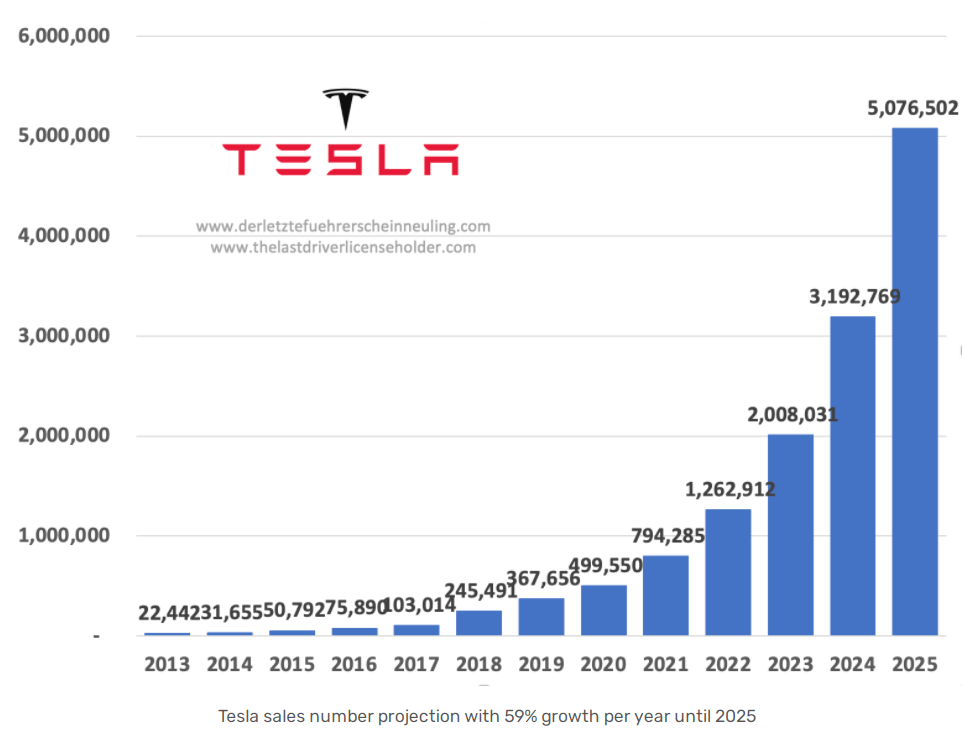

1. Continued Growth in Electric Vehicle (EV) Market Share: Tesla currently holds a dominant position in the EV market. Maintaining and expanding this market share will be essential for future growth. Factors influencing this include:

- Production Capacity and Efficiency: Tesla’s ability to scale production and achieve manufacturing efficiency will be vital. Its Gigafactories are a key element in this strategy.

- Innovation and Product Development: Continuously introducing new models, improving existing ones, and staying ahead of the competition in terms of technology and features are crucial.

- Regulatory Environment: Government incentives and policies favoring EVs, as well as stricter regulations on traditional gasoline vehicles, will significantly impact market demand.

2. Expansion into New Market Segments: Tesla’s focus on the luxury EV segment has been successful, but the company is expanding into more accessible price points with models like the Model 3 and Model Y. This expansion will increase its customer base and market penetration.

3. Growth of Tesla’s Energy Business: Tesla’s energy division, encompassing solar panels, energy storage systems, and charging infrastructure, is a key growth area. This segment provides diversification and potential for significant revenue generation.

4. Technological Advancements: Tesla’s commitment to technological advancements, including autonomous driving, software updates, and artificial intelligence, will be crucial for maintaining its competitive edge. These advancements can enhance product value and attract new customers.

5. Global Economic Conditions: Global economic conditions, including interest rates, inflation, and consumer confidence, will influence demand for Tesla’s products. A strong global economy will likely benefit Tesla, while economic downturns could pose challenges.

6. Competition: Tesla faces increasing competition from established automakers and new entrants in the EV market. Maintaining a competitive edge in terms of technology, pricing, and brand image will be crucial.

Potential Scenarios and Valuation Estimates

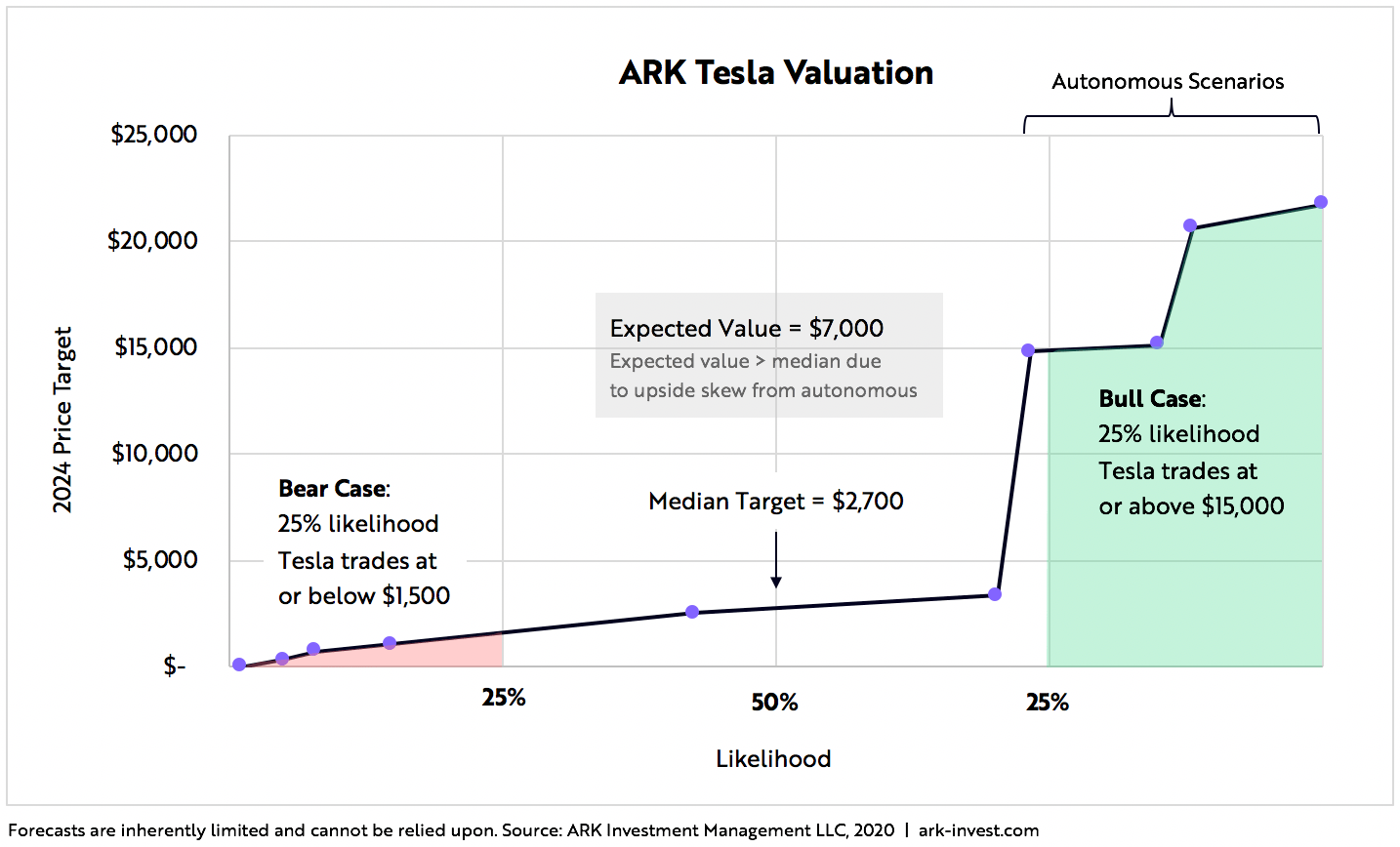

Based on these key drivers, several potential scenarios for Tesla’s value in 2030 can be considered:

Scenario 1: Continued Dominance and Expansion

- Tesla maintains its market leadership in the EV segment, significantly expanding its global footprint and market share.

- Its energy business flourishes, becoming a major player in renewable energy solutions.

- Technological advancements, particularly in autonomous driving, drive significant value creation.

- Under this scenario, Tesla’s valuation could reach astronomical heights, exceeding its current market capitalization by several folds.

Scenario 2: Moderate Growth and Competition

- Tesla faces increased competition from established automakers and new EV players.

- Its market share growth slows down, but it remains a significant player in the EV market.

- The energy business contributes positively to revenue, but does not reach the same level of dominance as the automotive segment.

- In this scenario, Tesla’s valuation would likely grow significantly, but at a more moderate pace compared to the first scenario.

Scenario 3: Challenges and Setbacks

- Tesla encounters significant challenges in production capacity, technology development, or regulatory hurdles.

- Its market share growth stagnates or declines, leading to reduced profitability.

- The energy business fails to meet expectations, and the company struggles to compete in a rapidly evolving market.

- Under this scenario, Tesla’s valuation could experience significant decline, although it is unlikely to fall to pre-2020 levels given its established brand and loyal customer base.

FAQs

Q: What factors will influence Tesla’s valuation in 2030?

A: Tesla’s valuation in 2030 will be influenced by its ability to maintain market share, expand into new segments, innovate and develop new technologies, manage production capacity, and navigate the competitive landscape, alongside global economic conditions and regulatory environments.

Q: How can Tesla sustain its growth trajectory?

A: Sustaining growth requires continuous innovation, efficient production, strategic expansion into new markets, and a strong commitment to technological advancements, including autonomous driving and renewable energy solutions.

Q: What are the potential risks to Tesla’s future value?

A: Risks include increased competition, production bottlenecks, regulatory changes, economic downturns, and challenges in scaling its energy business.

Tips for Investors

- Conduct thorough research: Understand Tesla’s business model, its strengths and weaknesses, and the competitive landscape.

- Consider multiple scenarios: Evaluate potential outcomes based on various factors, including market growth, technological advancements, and economic conditions.

- Diversify investments: Don’t put all your eggs in one basket. Diversify your portfolio to mitigate risks and maximize returns.

- Monitor market trends: Stay informed about developments in the EV market, energy sector, and technology.

Conclusion

Predicting Tesla’s value in 2030 is an exercise in informed speculation. The company’s future success will depend on its ability to navigate a complex and dynamic landscape, adapt to changing market conditions, and maintain its commitment to innovation. While various scenarios exist, it is clear that Tesla’s future holds significant potential, driven by its leadership in the EV market, expansion into new segments, and focus on technological advancements. The ultimate value of Tesla in 2030 will be determined by its ability to execute its strategy and capitalize on emerging opportunities.

Closure

Thus, we hope this article has provided valuable insights into Predicting Tesla’s Value in 2030: A Look at Factors Shaping the Future. We appreciate your attention to our article. See you in our next article!