Predicting Tesla’s Valuation in 2025: A Complex Equation

Predicting Tesla’s Valuation in 2025: A Complex Equation

Introduction

With great pleasure, we will explore the intriguing topic related to Predicting Tesla’s Valuation in 2025: A Complex Equation. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Predicting Tesla’s Valuation in 2025: A Complex Equation

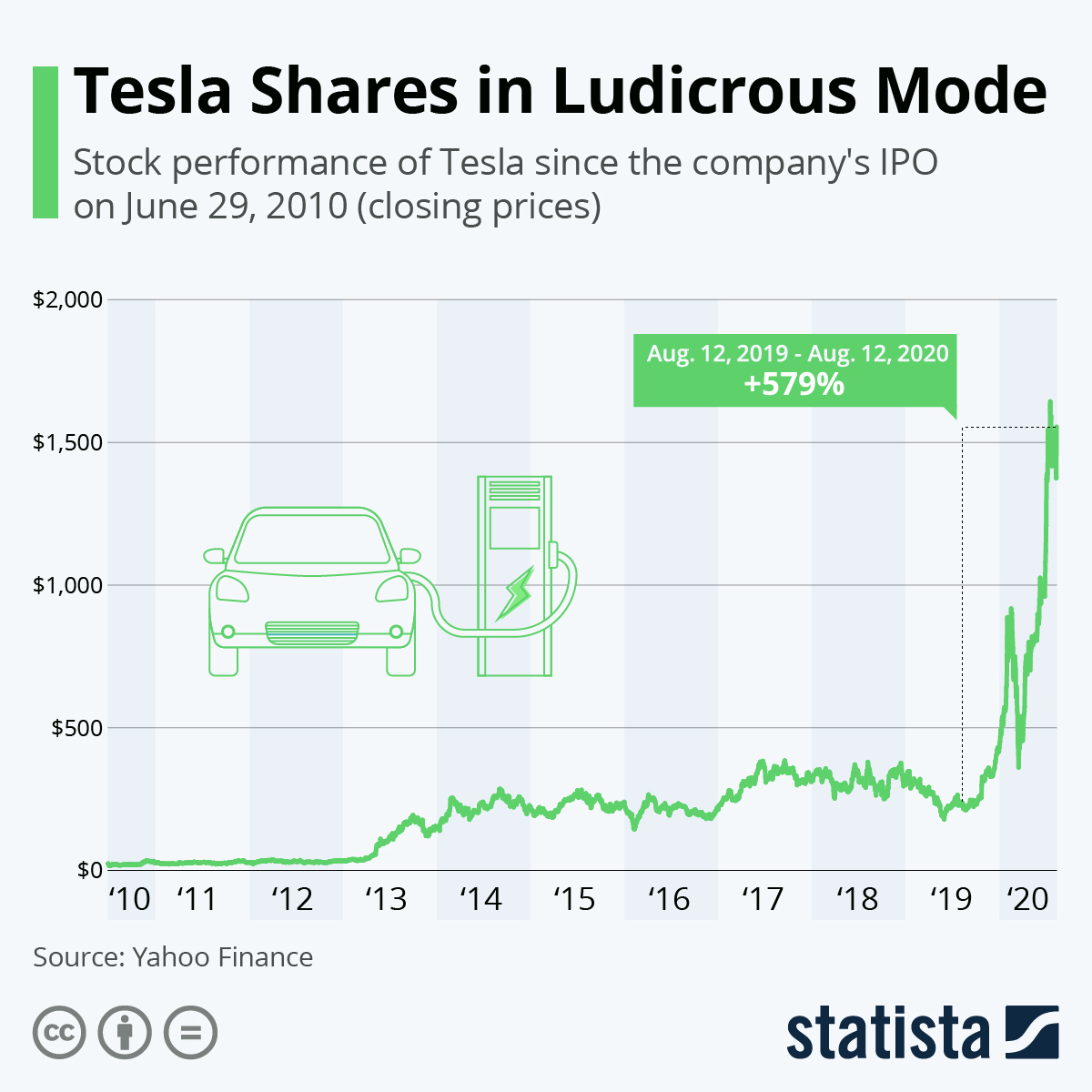

Predicting the future value of any company, particularly one as dynamic as Tesla, is a complex endeavor. Numerous factors influence the trajectory of a company’s stock price, making it difficult to pinpoint an exact figure. However, by analyzing key drivers and market trends, we can gain a more nuanced understanding of the potential range for Tesla’s valuation in 2025.

Key Drivers of Tesla’s Future Valuation

Several factors will significantly impact Tesla’s valuation in the coming years. These include:

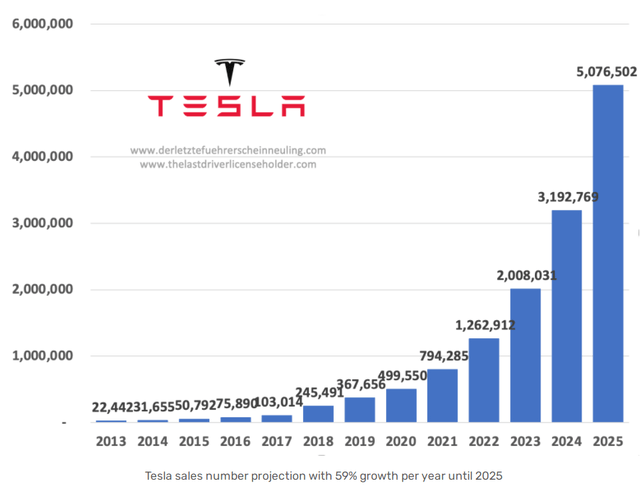

1. Growth in Electric Vehicle (EV) Sales: Tesla’s core business is the production and sale of electric vehicles. The global EV market is experiencing rapid growth, fueled by increasing demand for sustainable transportation, government incentives, and technological advancements. Tesla’s ability to maintain its market share and expand production capacity will be crucial to its future success.

2. Expansion into New Markets: Tesla is actively expanding its presence in new markets, particularly in Asia and Europe. As the company penetrates these regions, its revenue streams diversify, potentially leading to increased valuation.

3. Technological Innovation: Tesla is known for its cutting-edge technology, particularly in areas like autonomous driving and battery technology. Continued innovation and development in these areas will be vital for maintaining Tesla’s competitive edge and driving future growth.

4. Profitability and Margins: Tesla has historically struggled with profitability, but recent improvements in production efficiency and cost management have led to increased margins. Continued focus on profitability and sustained growth in earnings will be key factors influencing investor confidence and valuation.

5. Competition: The EV market is becoming increasingly competitive, with established automakers like Volkswagen, General Motors, and Ford aggressively investing in electric vehicles. Tesla’s ability to stay ahead of the competition in terms of technology, production capacity, and brand recognition will be critical.

6. Regulatory Environment: Government policies and regulations play a significant role in shaping the EV market. Factors like tax incentives, emissions standards, and infrastructure development can impact Tesla’s valuation.

7. Market Sentiment and Investor Confidence: Tesla’s stock price is heavily influenced by market sentiment and investor confidence. Factors like Elon Musk’s public pronouncements, news coverage, and overall economic conditions can significantly impact investor perception and valuation.

Potential Scenarios for Tesla’s Valuation in 2025

Given the complexities and uncertainties involved, it’s impossible to predict Tesla’s exact valuation in 2025. However, we can explore potential scenarios based on the key drivers discussed above:

Scenario 1: Continued Growth and Dominance: If Tesla maintains its dominant position in the EV market, continues to innovate, expands into new markets, and achieves consistent profitability, its valuation could continue to grow significantly. Some analysts predict a valuation exceeding $1 trillion by 2025, potentially reaching levels similar to Apple or Microsoft.

Scenario 2: Moderate Growth and Competition: If Tesla faces increased competition from established automakers and struggles to maintain its current growth trajectory, its valuation might see more moderate growth. However, its strong brand recognition, technological advancements, and established infrastructure could still lead to a substantial valuation, potentially reaching $500 billion or more by 2025.

Scenario 3: Stalled Growth and Challenges: If Tesla encounters significant challenges in its expansion plans, faces technological setbacks, or struggles to maintain profitability, its valuation might stagnate or even decline. In this scenario, its valuation could remain below its current levels, potentially falling to $200 billion or less by 2025.

FAQs on Tesla’s Valuation in 2025

Q: What are the key factors driving Tesla’s valuation?

A: Tesla’s valuation is driven by factors like EV sales growth, technological innovation, expansion into new markets, profitability, competition, regulatory environment, and investor sentiment.

Q: How does the global EV market impact Tesla’s valuation?

A: The rapid growth of the EV market presents significant opportunities for Tesla. However, increased competition from established automakers also poses challenges. Tesla’s ability to maintain its market share and expand production capacity will be crucial.

Q: What is the role of technology in Tesla’s future valuation?

A: Technological innovation, particularly in areas like autonomous driving and battery technology, is critical for Tesla’s future success. Continued advancements in these areas will be key to maintaining a competitive edge and driving valuation growth.

Q: How important is profitability for Tesla’s valuation?

A: Profitability and sustained growth in earnings are crucial for investor confidence and valuation. Tesla’s ability to achieve consistent profitability and improve margins will be a key factor influencing its future stock price.

Q: What are the potential risks to Tesla’s valuation?

A: Potential risks include increased competition from established automakers, technological setbacks, regulatory changes, economic downturns, and negative investor sentiment.

Tips for Understanding Tesla’s Future Valuation

1. Analyze Industry Trends: Keep abreast of developments in the EV market, including sales figures, government policies, and competitive landscape.

2. Monitor Technological Advancements: Track Tesla’s technological progress, particularly in areas like autonomous driving and battery technology.

3. Follow Financial Performance: Analyze Tesla’s financial reports, paying attention to revenue growth, profitability, and cash flow.

4. Consider Market Sentiment: Stay informed about investor sentiment towards Tesla, including news coverage, analyst ratings, and Elon Musk’s public pronouncements.

Conclusion

Predicting Tesla’s valuation in 2025 is a complex exercise, with numerous factors influencing its future trajectory. The company’s success will depend on its ability to navigate a rapidly evolving EV market, maintain technological leadership, expand into new markets, achieve consistent profitability, and manage investor expectations. While the future is uncertain, Tesla’s innovative spirit, strong brand recognition, and significant market presence position it for continued growth and potentially a substantial valuation in the coming years.

Closure

Thus, we hope this article has provided valuable insights into Predicting Tesla’s Valuation in 2025: A Complex Equation. We hope you find this article informative and beneficial. See you in our next article!