Navigating the Uncharted Waters: Forecasting Lucid Motors’ Stock Price in 2025

Navigating the Uncharted Waters: Forecasting Lucid Motors’ Stock Price in 2025

Introduction

With great pleasure, we will explore the intriguing topic related to Navigating the Uncharted Waters: Forecasting Lucid Motors’ Stock Price in 2025. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Navigating the Uncharted Waters: Forecasting Lucid Motors’ Stock Price in 2025

Predicting the future of any publicly traded company, especially one operating in a rapidly evolving industry like electric vehicles (EVs), is a complex undertaking. Lucid Motors, a relatively young player in the EV market, has garnered significant attention for its high-performance luxury vehicles and ambitious growth plans. While predicting the precise stock price of Lucid in 2025 remains a challenging task, analyzing key factors influencing its trajectory can provide valuable insights for investors.

Factors Influencing Lucid’s Stock Price:

1. Production Ramp-up and Delivery Growth:

Lucid’s ability to scale production and meet its ambitious delivery targets will be paramount in determining its stock price. The company aims to increase production significantly, expanding its manufacturing facilities and refining production processes. Achieving these goals will be crucial for generating revenue, capturing market share, and demonstrating its ability to compete with established EV giants.

2. Market Demand and Consumer Acceptance:

The success of any EV company hinges on consumer acceptance and demand for its products. Lucid’s focus on luxury and performance positions it in a niche market, attracting a specific segment of buyers. The company’s ability to appeal to this target audience and expand its customer base will be crucial for driving sales and revenue growth.

3. Technological Innovation and Differentiation:

Lucid differentiates itself through its advanced technology, including its proprietary battery technology, efficient electric powertrains, and innovative driver assistance systems. Continuously innovating and developing new features will be vital for maintaining a competitive edge and attracting customers in a rapidly evolving EV landscape.

4. Financial Performance and Profitability:

Lucid is currently operating at a loss, a common characteristic of many young EV companies. Achieving profitability will be essential for establishing long-term sustainability and attracting investors. This will require careful management of costs, efficient production processes, and strategic pricing strategies.

5. Competition and Market Dynamics:

The EV market is becoming increasingly crowded with established players like Tesla, Volkswagen, and General Motors, as well as emerging startups. Navigating this competitive landscape will require Lucid to continuously adapt its strategies and offer compelling products and services to stand out.

6. Regulatory Environment and Government Support:

Government policies and incentives, such as tax credits and subsidies, can significantly impact the EV market. Lucid’s ability to leverage these advantages and navigate regulatory hurdles will be crucial for its success.

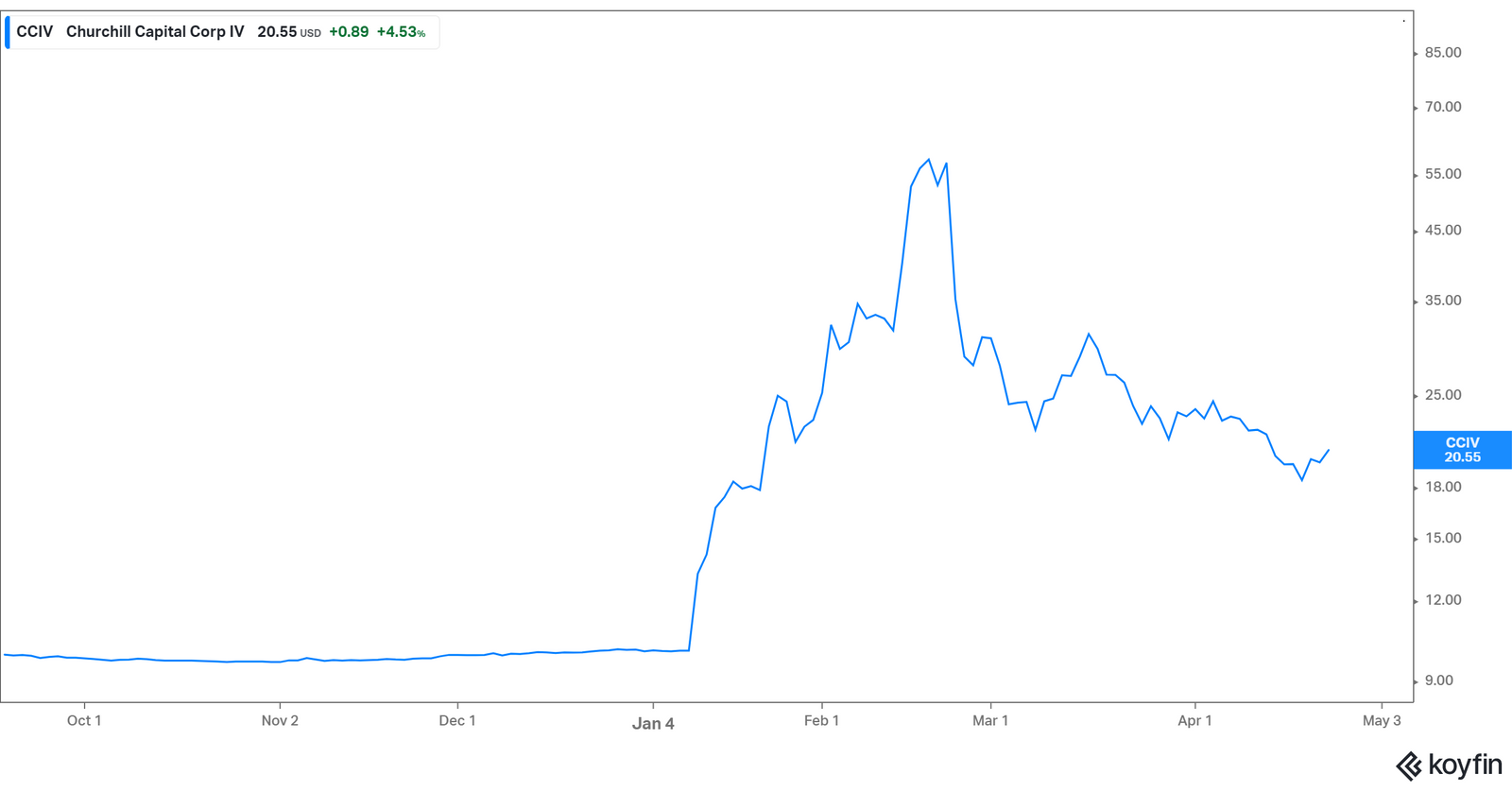

7. Investor Sentiment and Market Volatility:

Investor sentiment towards the EV industry and individual companies can fluctuate significantly. Factors like economic conditions, geopolitical events, and overall market volatility can influence stock prices.

Predicting the Future:

Given the multitude of factors influencing Lucid’s stock price, predicting its value in 2025 is fraught with uncertainty. However, by analyzing these factors and assessing Lucid’s progress in key areas, investors can gain a better understanding of the potential trajectory of its stock.

FAQs by Lucid 2025 Stock Price:

1. Is Lucid Motors a good investment?

Lucid Motors is a high-growth company with significant potential, but also carries inherent risks. The decision to invest in Lucid is a personal one, dependent on individual risk tolerance, investment goals, and assessment of the company’s future prospects.

2. What are the risks associated with investing in Lucid Motors?

Investing in Lucid Motors involves risks similar to other growth companies, including:

- Execution risk: The ability to scale production, meet delivery targets, and manage operating costs effectively.

- Market competition: The competitive landscape in the EV market is becoming increasingly intense.

- Technological advancements: Rapid technological advancements in the EV industry could render existing models obsolete.

- Financial performance: Lucid is currently operating at a loss, and achieving profitability is crucial for long-term sustainability.

- Regulatory uncertainty: Government policies and regulations surrounding the EV industry can evolve rapidly.

3. How can investors assess the potential of Lucid Motors?

Investors can assess the potential of Lucid Motors by:

- Analyzing financial reports: Scrutinizing revenue growth, profitability, and cash flow statements.

- Monitoring production ramp-up and delivery targets: Evaluating the company’s ability to meet its production goals.

- Assessing market demand and consumer acceptance: Observing sales figures and customer feedback.

- Tracking technological advancements: Evaluating the company’s innovation pipeline and its ability to differentiate itself.

- Staying informed about industry trends: Keeping abreast of developments in the EV market and competitive landscape.

Tips by Lucid 2025 Stock Price:

- Conduct thorough research: Understand the company’s business model, financial performance, and key risks before making any investment decisions.

- Diversify your portfolio: Don’t invest all your capital in a single stock, especially a high-growth company like Lucid Motors.

- Invest for the long term: The EV industry is still evolving, and Lucid’s stock price may experience fluctuations in the short term.

- Seek professional advice: Consult with a financial advisor to understand your investment goals and risk tolerance before investing.

Conclusion by Lucid 2025 Stock Price:

Lucid Motors is a promising player in the rapidly growing EV market, with the potential to capture a significant share of the luxury segment. However, predicting its stock price in 2025 is challenging due to the many factors influencing its trajectory. Investors need to carefully assess the company’s progress in key areas like production ramp-up, market demand, technological innovation, and financial performance to make informed investment decisions. While the future of Lucid remains uncertain, its potential for growth and disruption in the EV industry makes it an intriguing company to watch.

Closure

Thus, we hope this article has provided valuable insights into Navigating the Uncharted Waters: Forecasting Lucid Motors’ Stock Price in 2025. We thank you for taking the time to read this article. See you in our next article!